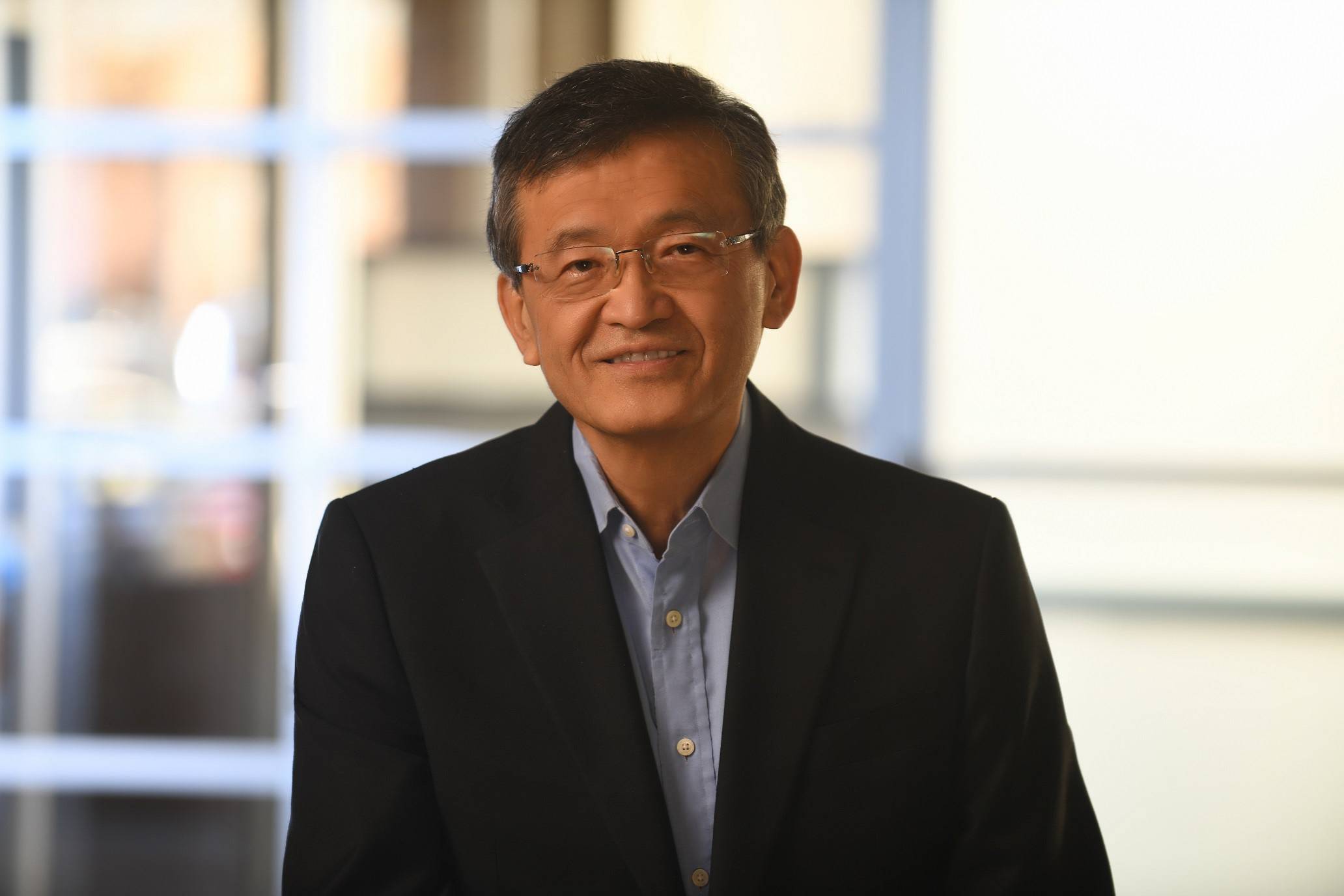

Dr. Sekar Jaganathan, Chief Business Officer of Kenanga group shares his thoughts on customer journeys, business transformation and what AI can do for the financial industry.

In a highly competitive and regulated industry, Dr. Sekar Jaganathan is no stranger to managing customer expectations, and leading teams to address evolving market demands head-on. One of the most striking lines from Dr. Sekar during our conversation is that good leaders must be visionaries.

“If you want to be a good leader, you need to be a visionary – a visionary to understand how the world is changing, how the world will be in the next year and years. What’s driving the change? And you should be able to tell your team this is where the world is headed, because they must know that whatever they are delivering is not for today, they are delivering to stay ahead in the future.”

A great piece of advice for C-suite leaders, but it is easier said than done. Dr. Sekar comes with a background rich in technology, having started his career with the Kenanga group in predominantly tech-focused roles. With 30 years of experience, Dr. Sekar brings together commercial needs and innovation to create future-looking models.

The industry itself comes with a unique set of challenges – it is highly regulated, complex (to the common customer), and often a testbed for technologies such as blockchain, and AI. Speaking about initiating transformation, Dr. Sekar values processes that bring about a positive impact to the actual customer experience or received value, rather than just increasing profitability or efficiency for the business.

“When you do operational transformation, it’s more from the cost perspective. When you optimize your costs, that doesn’t mean you’re actually growing your business. Instead, Dr. Sekar proposes that transformation must help organizations operate better, be able to achieve business growth, and at the same time, create greater value for customers, not just improving customer experience. Greater value to customers can be in forms of better quality of products, new innovation, or even more value for money spent. In Dr. Sekar’s domain, this would translate to better success rates in driving profitability for the customers, not just for the business.

Leading the Way with a Customer-First Strategy

Dr. Sekar leads by a number of principles when it comes to defining an innovation strategy with customers at the heart of it. First, the customers own the money and the role of the business is to protect it. The second is to create the best investment value without using the word guaranteed. This principle is to ensure that full transparency and accountability are visible to customers, and that the organization is clear about different variables that can influence investment decisions.

“The most challenging thing is being product innovative. Every financial product we introduce has to pass regulations and its terms within the licensed scope. How do you do so, whilst keeping to the third principle of actually making it attractive?”

Designing a customer journey for customers starts with defining the must-knows, especially risks of any investment products that a customer may engage with. Whether the journey is digital, or via more traditional channels, the customer must be aware of the potential financial risks and implications. On the flip side, financial institutions must be able to recognize bad actors, who may abuse offered services as means to market manipulation.

“There are safeguards we put in place hence the onboarding process is more rigid when compared to onboarding a customer to a retail bank’s financial services”.

Part of the safeguards may result in a longer process where customers are expected to provide much more information, and hence take a longer time to actually be onboarded. With customers becoming more entrenched in ecommerce culture, Dr. Sekar asks how should organizations keep customers informed and excited about this long-drawn process?

The answer can be simple yet effective – it is about managing customer expectations, and providing “checkpoints” throughout the process. “As customers go through the onboarding questions, we can provide them with an update of how far along they are, and at the same time, provide them with relevant information on what’s in it for them. Then they’re re-motivated to continue. That’s the emotional challenge that we have to address without actually making customers feel like they are being retargeted for other purposes, other than the task at hand.”

Innovate and Lead, or Be Left Behind

There are numerous benefits to being an early adopter of technology. And studies show that fintech in Asia Pacific is enroute to outpace the US by 2030, with a projected CAGR of 27%.

When asked about his thoughts on artificial intelligence in the investment space, Dr. Sekar highlighted the benefits of applying precision to investing using historical data, market trends, and behavioral data. Using artificial intelligence allows the team to develop multiple correlational models, and to seamlessly integrate data points for probability findings. Whilst it’s not “guaranteed”, Dr. Sekar said that applying such innovation ensures best effort on behalf of their customers, and gives their clientele the upside in terms of investing.

While others may see leveraging AI as a threat to losing the human touch, this aspect actually builds more trust for financial services customers.

“It takes away personal emotions when it comes to managing your investments. This creates better trust with our customers. It’s a very scientific and methodical approach. From a sales perspective, what is going to drive me to do more sales is not to sell to the business’ benefit, but to use technology to drive the best outcomes for our customers.”

“When artificial intelligence is used the right way, it’s more scientific and precise in ensuring our customers get the best value out of their investments.”

Gen MZ or Boomers – the Key is to Build What Your Customers Need

In his experience, Dr. Sekar doesn’t actually see a distinction between younger customers preferring a digital journey, compared to the older audiences. It all comes down to the needs of the customers – whether they prefer speaking to their relationship managers, or go for self-directing trading. Customers choose according to what makes the most sense for them, in terms of time, or resources. For example, lower costs of investing when they perform the trade themselves, can be appealing enough for some to learn and adopt technology.

When asked whether financial services institutions should try to recreate the offline customer experience to digital, Dr. Sekar opined that these organizations should choose to not mirror, but to improve upon it.

“A relationship manager may read about five pieces of news a day then advise our customer. In the digital space, for example on our stock screener, we can enable a convergence of statistics, data and facts to provide an advisory to our customers. That is beyond what one human being can do within a day.”

However, data is static unless the organization has an idea of what to do with it. Relationship managers, while having limitations in terms of processing power, have their experience, insights, and a clear understanding of customer needs that still sets them apart.

Besides applying his deep understanding of how technology can complement peoples’ expertise, Dr. Sekar is also a learner and believer in applying emotional intelligence in all aspects of work.

“It’s about getting the customers to understand the trust we try to build. Every human being makes decisions based on certain levels of emotion – how do I capture and fulfill that emotion (need) in the shortest time possible?”

Digital businesses are well poised to direct and execute processes in an efficient way, but organizations need to make a choice to acknowledge and address customers’ emotional needs, even if they cannot fulfill the task at hand. Dr. Sekar leaves us with a piece of advice that for all customer experience designs, do not design in isolation. C-suite leaders must collaborate closer, bring together customer and commercial needs from all fronts, so that they will be able to come up with a winning customer strategy.