The viability of emerging technologies and the fundamental requirements of enterprise-grade, mission-critical IT infrastructure, comes into focus again.

The recent breakdown of the Australian Securities Exchange’s (ASX) CHESS settlement system just before Christmas 2024 has reignited discussions about blockchain’s viability in the enterprise space, particularly given the exchange operator’s high-profile abandonment of its blockchain-based CHESS replacement project in late 2022.

This setback, combined with similar retreats from blockchain initiatives by other major corporations, has raised questions about blockchain technology’s enterprise readiness.

The exchange had partnered with Digital Asset Holdings to replace its CHESS (Clearing House Electronic Subregister System) platform using distributed ledger technology. In November 2022, ASX announced a pause in the CHESS Replacement Program to reassess all aspects of the project after investing about AUD250 million.

ASX’s cited reasons for abandonment—complexity and scalability concerns—echo challenges many enterprises face when implementing blockchain solutions.

According to documentation, “the process to evaluate replacement options for CHESS came at a time when Distributed Ledger Technology (DLT) was emerging as a credible platform solution that could provide the kind of innovation and longevity which allowed CHESS to be world-leading when it was first introduced in 1994.”

(Credit: ASX)

By April 2018, following a two-year proof of concept (POC) exercise, ASX began an industry consultation process to assess business requirements for a DLT-based solution to replace CHESS. An April 2021 go-live date for CHESS was announced in 2019, but any hopes of this materializing were dashed in 2022.

The recent CHESS outage, while seemingly unrelated to the replacement project, has paradoxically brought these issues — the viability of an emerging technology in the enterprise space and the fundamental requirements of reliable IT infrastructure — back into focus.

Enterprise Blockchain: Promise vs. Reality

The enterprise blockchain landscape has evolved significantly since the technology first captured corporate imagination in the mid-2010s. While early adopters rushed to implement blockchain solutions across various use cases, recent years have seen a more measured approach, with companies focusing on specific problems where blockchain’s unique and intrinsic capabilities can offer advantages.

Several enterprise blockchain initiatives have shown promise, especially those with the following use cases:

– Supply chain tracking systems implemented by major retailers like Nestlé and Samsung

– Trade finance platforms developed by banking consortiums like Digital Trade Chain, we.trade, Contour, and Marco Polo

– Digital identity solutions in healthcare sectors, such as those developed by the Worldcoin Foundation and ConsenSys

However, multiple projects have been quietly shelved. Common challenges include:

- Integration Complexity: Blockchain systems often require significant modifications to existing enterprise architecture

- Superior Alternatives: Existing technologies have been found to be more suitable

- Cost-Benefit Imbalance: The overhead of implementing and maintaining blockchain systems sometimes outweighs their benefits

The Path Forward: embracing pragmatism with emerging tech

Having closely followed the CHESS replacement program, Radmis Advisory’s Penny Wong said lessons from the ASX blockchain CHESS replacement program, highlight a fundamental truth: transformation projects fail when there is misalignment between the vision and the reality of an organization’s readiness to adopt and integrate an emerging technology into a corporate environment.

“When millions have already been spent and reputational capital is on the line, it becomes increasingly difficult for leadership to step back, reassess, and admit the trajectory may not align with reality. Instead, projects keep moving forward … not because they’re viable, but because so much has already been invested.”

Penny Wong

“The failure wasn’t solely about the blockchain itself, it revealed a broader issue of readiness across people, process, technology, and compliance. The project fell short because the organization lacked the necessary foundation to effectively adopt and operationalise such an ambitious vision. And not to the fault of any BAU (business as usual) resources.”

She also opined that ASX’s blockchain project is a textbook example of how organizations can fall victim to the sunk cost fallacy. “When millions have already been spent and reputational capital is on the line, it becomes increasingly difficult for leadership to step back, reassess, and admit the trajectory may not align with reality.

“Instead, projects keep moving forward … not because they’re viable, but because so much has already been invested.”

Best Practices

According to Penny, when a company commits to a major project, the investment typically should align with at least one (preferably more) of 4 main core board-level pillars to deliver a measurable return-on-investment (ROI)

– Revenue Assurance

– Cost Optimization and Reduction

– Risk and Compliance

– Customer Experience (CX)

The CEO of Goldman Sachs is reported as having told The Wall Street Journal, “Blockchain is much more than crypto, and regulated financial institutions are well positioned to harness the revolutionary technology.”

What happened with ASX and several other shelved projects suggests that this is easier said than done.

Aligning people, process, and technology is easier said than done.

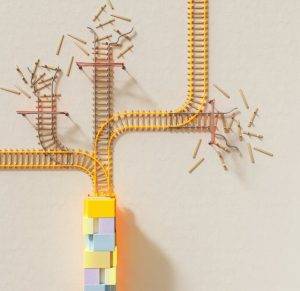

Penny observed, “Blockchain, like any emerging technology, is a tool not a strategy. They sold the dream of blockchain like a golden gravy train but forgot the tracks. It wasn’t the tech that failed, it was the organization’s readiness. Emerging tech isn’t plug-and-play… especially into an enterprise shackled in legacy systems… it’s about people, process, and culture.

“Blockchain doesn’t fix that.”

Other aspects to address in a digital transformation project

Penny also shared that when she executes rescue missions of IT projects, there are two departments that can kill any project—information security and legal (due to non-compliance).

To circumvent this, she recommended involving both legal and security early in the process. “If you bring them to the conversation as early as possible, they’re unlikely to kill your project in the eleventh hour.”

The same holds true for organizations in regulated industries like financial services. Penny added, “I would approach the regulator upfront. This de-risks your project from failing or being shut down.”

The key is to educate and get stakeholders comfortable with new technology before deeper engagement. When implementing new technologies, ensuring the right skills are in the right roles, is also important.

Penny concluded, “You can train your team, bring skill sets from outside, or partner with a supplier; and I emphasize that this should be a partnership and not a supplier/vendor relationship.”