Big Tech being Big Tech: It comes as no surprise that their data center moves have large implications upon national grids, for example. The Economist Intelligence Unit has the report, while CXpose.tech outlines the highlights below.

The EIU report provides a comprehensive and timely analysis of the burgeoning data center industry in Asia, highlighting the complex interplay between technological advancement, energy consumption, and regulatory landscapes.

Key insights:

- Data centres will exert more pressure on national grids as usage of artificial intelligence (AI) increases. Understandably governments are anxious about how already struggling grids will cope with the extra electricity consumption as AI usage increases. The UK’s National Grid foresees a six-fold jump in electricity demand from data centres from now until 2034, driven by AI-related data processing. Meanwhile, tech companies, which build data centre hubs, are taking pre-emptive measures as governments intensify energy usage and emissions reporting standards.

- Data centre companies look for three things when they invest: reliable power, land availability and data policy.

-

- Power failures following an extreme weather condition could also lead to data centres experiencing disruption and thereby, relying on a back-up generator.

- According to Cushman and Wakefield, a real estate company, the average acreage for a data centre in North America is 80 acres. But access to such large parcels of land in major cities is a challenge. This explains why companies are looking at secondary cities in Germany, Mexico, Saudi Arabia and Chile.

- Currently legislations covering data storage, processing and transfer vary across countries. In India digital payments platforms must store data locally. In South Korea companies can transfer personal data only to countries with a similar data-privacy framework. The enforcement of data laws determines where companies will store their data and that in turn will influence where data centres are built.

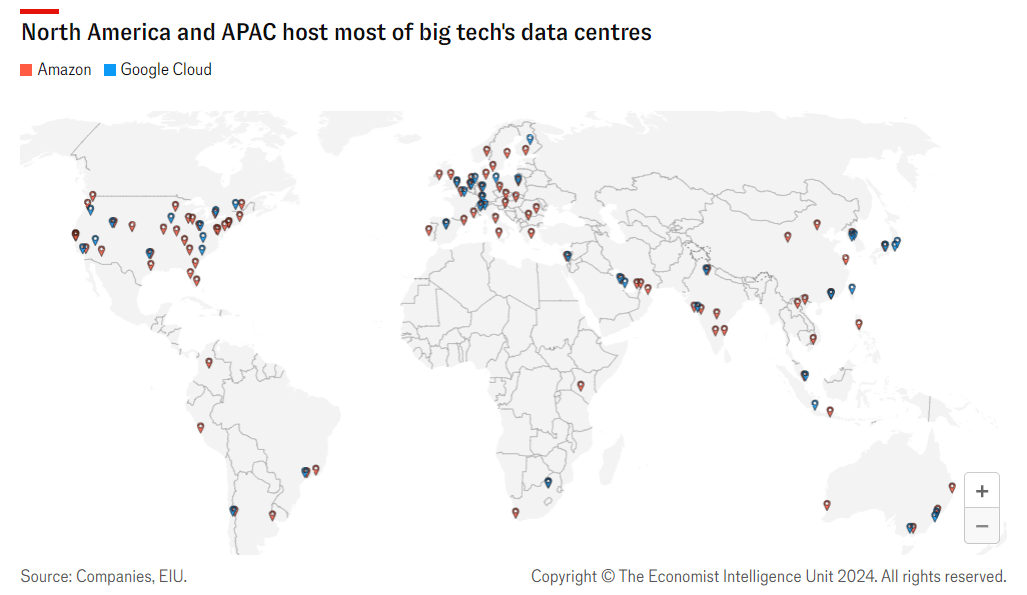

- Currently the US hosts the majority of the world’s data centres with a few cities in other regions also being popular cloud hubs. However, big tech’s investments suggest they will move cloud regions beyond North America and build the bulk of their new infrastructure in the Asia Pacific region.

- Singapore, Hong Kong, China, South Korea, Japan, India, Australia have multiple cities that host several data centres. In addition to expansion plans in existing markets, cloud companies will build new infrastructure in Thailand, Malaysia, Taiwan and New Zealand.

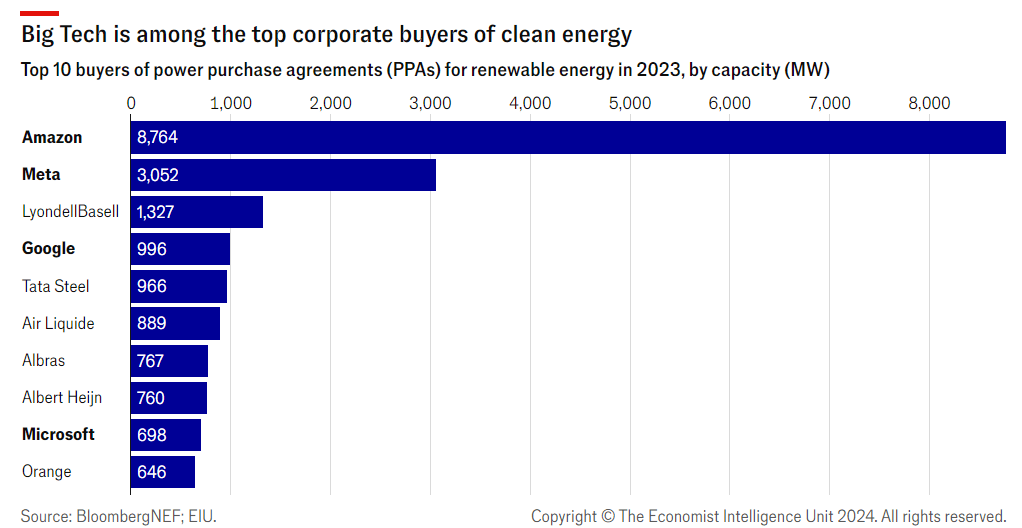

- Given the anticipated pressure on national grids, big tech is looking for alternative ways to power their data centres, and also reduce emissions. One way is through a power purchase agreement (PPAs) with electricity generators, which will help data centre operators avoid relying entirely on the grid.

- Such agreements also enable compliance with upcoming regulation. For instance, the EU Energy Efficiency Directive requires data centres to report on metrics such as power unit efficiency by September 2024. Meanwhile, other countries such as Singapore are offering subsidies to data centre investors that use clean energy and meet emission standards.

- In July, the Chinese government announced plans to increase the renewable energy usage rate by 10% per year for data centres by 2025.

Slowly but surely data centres will be held accountable for energy usage among other things, although policies will remain far from uniform across regions.

(This article was adapted from a media alert)