A leading cloud and AI technology company, CloudMile, is trailblazing new paths in the Southeast Asia region by starting first-of-its-kind initiatives in close collaboration with Google Cloud and its technology partners. Besides, a center of excellence and building capabilities in AI and cloud-first practices among startups, CloudMile Malaysia forges a tight bond with the cloud ecosystem to enhance the depth and breadth of its subject matter expertise.

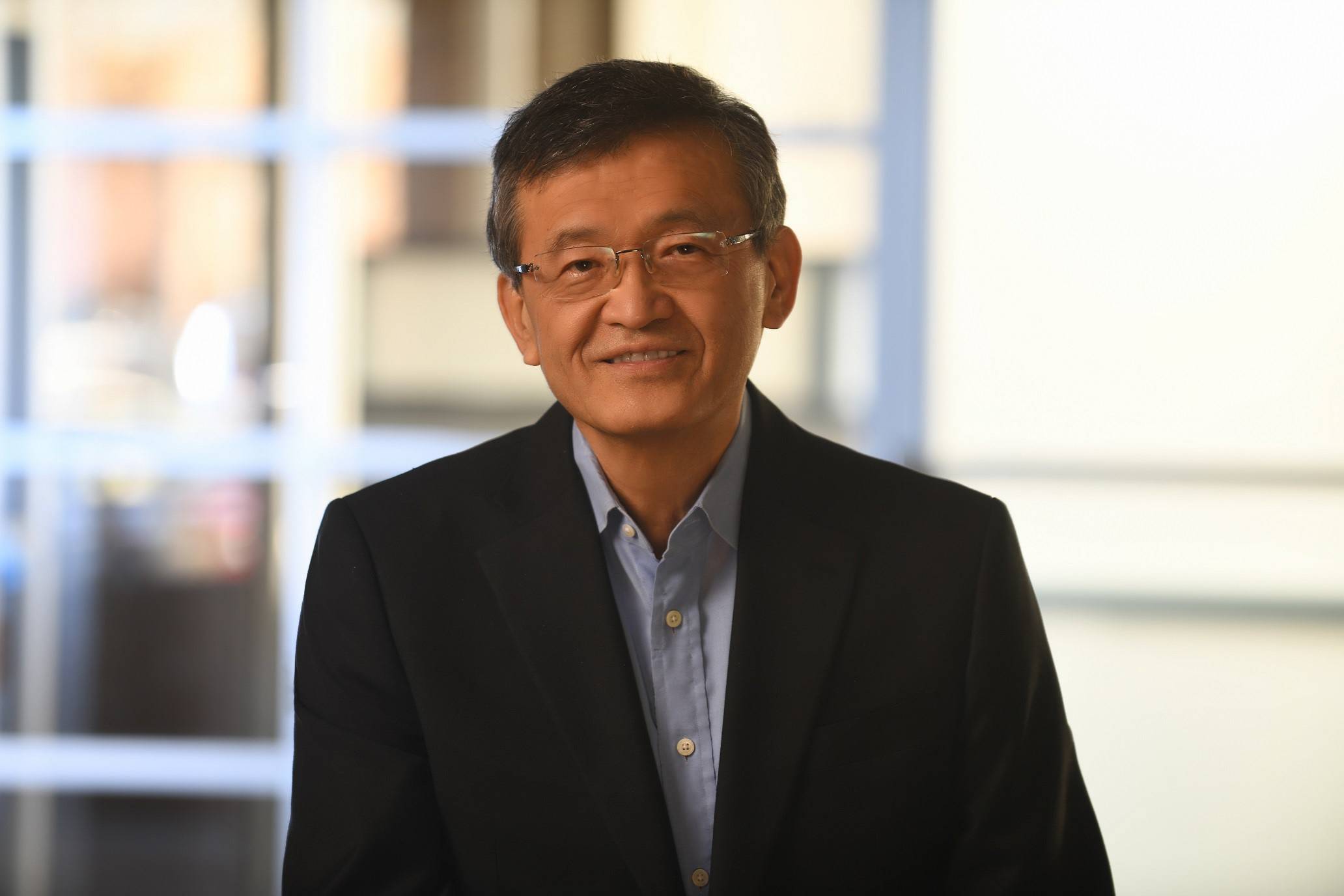

As a Google Cloud partner, CloudMile Malaysia highlights the importance of technology fundamentals and certifications. Country manager Lester Leong said, “We constantly get our team certified in all the different specializations that we focus on.”

It would work with their ecosystem of technology partners to quickly upgrade their knowledge and skills whenever new technology, capabilities, or features emerge.

“Being a Google Cloud Premier Partner, we have annual audits of our resources, certifications and our capabilities from a process, delivery, and managed services perspective to ensure they are all current,” Lester emphasized. That means always being up-to-date with the latest technology threshold which Lester is confident his team is.

Deep industry immersion

CloudMile is also working to beef up their subject matter expertise (SME) in the banking and finance services industry (BFSI) industry.”We want to invest resources into experienced subject matter experts who understand either traditional banking or digital banking, and be able to lead the team of technical experts forward with the language lingo, so we can strategize and structure the technology, customize solutions and support the bank with the objectives they want to achieve more quickly.”

Lester Leong, CloudMile

Currently, Google Cloud offers their expertise to support in this area, but Lester sees more value in having SMEs in-house who are able to conduct in-person meetings.

For Lester, just serving up the technology to clients and recycling the business use cases for them, will simply not do. A subject matter expert who has worked with banks before, and who knows their pain points, as well as how they are regulated would know how to move forward the bank’s business goals and how to apply CloudMile’s technical knowledge and expertise to meet these goals.

Besides helping to spur the managed service provider’s growth, this indirectly contributes to the customer’s experience of working with CloudMile and can create much needed stickiness.

Traditional banks adopting digital approaches

The BFSI and fintech startups, are a growing area of interest for CloudMile.

“The approach is very different. In traditional banks, you need to talk to many stakeholders from IT to business, and security to governance. The concerns they usually have is that due to the large traditional and legacy IT setup they have, moving to the cloud has to be executed in a manner that meets a lot of regulator requirements. So, the approach is a very long-cycle approach.”

Earlier this year, during the launch of CloudMile’s Centre of Excellence in Kuala Lumpur.

Data sovereignty is another requirement that the industry has, hence the demand for hyperscale data centers to be in the country, especially when conversations about cloud-based core banking systems are brought up, Lester shared.

So, traditional banks’ approach to cloud migration is slow and cautious, while fintechs do not have encumbrances to hold them back.

There are resource constraints, however.

“Fintechs are facing a resource crunch especially when business is coming in too fast and they are not able to scale resources or manage their technology fundamentals. That is why, many from this segment are talking to us about our managed services.”

For example, a current fintech client has two IT personnel to help it spin up IT resources to support the business, but they are overwhelmed by the exponential increase in business velocity.

IT resources like compute and storage needing to scale along with the increase in workloads and the increase in the number of users, addresses an FSI player’s operational requirements. But, a fintech that is growing may face requests for upgrades or enhancements to its products, like analytics. This is an imperative that fintechs face as they need to be unique and provide ‘sticky’ experiences to be able to acquire new customers.

“The existing developer resource may not have the time or bandwidth to support these requests. They may know application development, but not necessarily how to add analytics functions to all these apps and services.”

And in this way, a managed service provider like CloudMile is able to act as a customer’s external DevOps or infrastructure team and offload the the customer in-house team’s workload, as well as provide its expertise in areas like analytics and architecture optimisation to extend an FSI’s existing applications and digital offerings as the latter’s business grows.

Cloud project with regulatory oversight

Besides helping fintechs who face resource constraints and new IT environments, CloudMile works with financial institutions on the other end of the spectrum, that have enormous IT sprawls and regulatory requirements to comply with.

“We recently won a cloud project which has oversight from local regulators, Securities Commission, and the Ministry of Finance.”

The customer project potentially involves an entirely digital entity with a greenfield setup. How it is being set up is closely monitored by local regulators who intend to extract the best practices that could be replicated by FSI players that want to start new fintech entities.

Lester observed established financial institutions like CGC and AEON setting up digital versions of their financial functions, and quipped about how they are adopting technology faster with a willingness to try and experiment.

There are many business opportunities that the digital arm can help financial institutions with, for example use cases like payment gateways, eKYC (electronic know-your-customer), and loan or financing approvals, are focused, niche, and ripe to be executed in smarter ways.

The country manager said, “This is why digital arms are always there to run with the most forward technologies and allow the banks to be able to operate more efficiently, and also expand into more new business models.”

Yet another project that is being closely monitored with strict oversight by regulators is the eKYC project by a local bank. Lester described, this project is the first of its kind for Google Cloud in Malaysia as it involves a core banking application and customer data, going onto the cloud.

Yet another project that is being closely monitored with strict oversight by regulators is the eKYC project by a local bank. Lester described, this project is the first of its kind for Google Cloud in Malaysia as it involves a core banking application and customer data, going onto the cloud.

Together with the customer, CloudMile is working on regulatory approval to launch the solution. This involves coming up with a compliance checklist in areas like data governance, cloud security, stress tests and more. CloudMile will also carry out the necessary certifications, provide the supporting documentation, as well as technical justifications behind the solution that the customer wants to implement.

Google Cloud, which CloudMile partners with intensively and extensively, has the Google For Startups Cloud Program, that offers Google technologies at subsidized price to startups that have business models around AI, data, security, and ESG.

Besides that, CloudMile provides a cloud security posture management (CSPM) tool that ensures financial services players have visibility into the status of their compliance with local regulations and prompts on how to do so.

Lower barrier to entry with access to tech resources

Lester shared that technologies like AI are ready to help banks and other FSI players improve banking services with capabilities like more personalized product recommendations based on the customer’s behavior on banks’ online properties. Customer data and insights through analytics can help create customized and tailored services for a bank’s different customer segments, while AI and machine learning can help to quickly develop and launch new products and services.

But there are challenges to mainstream adoption of AI, like lack of data governance which can ensure clean and consolidated data for AI engines. The basic IT environment to support AI deployments does not seem to be ready yet, he observed.

Eighty percent of CloudMile’s business comes from the enterprise space, while 20% is with startups and the education sector. Lester explained, “While we want to help enterprises to transform their digital journey, we also want to nurture our startups to help our nation produce more entrepreneurs and successful unicorns, and at the same time plug the brain drain.”

Google Cloud, which CloudMile partners with intensively and extensively, has the Google For Startups Cloud Program, that offers Google technologies at subsidized price to startups that have business models around AI, data, security, and ESG. The program provides access to AI, data, and cloud services, as well as resources, which CloudMile operationalizes via free guidance, managed services, and mentorship for these startups and private education institutions.

Lester shared that since becoming involved with the program, some of these organizations, especially startups have become CloudMile’s customers as they started to convert their IT environment to produce commercial products and services that generate revenue. “This was not a focus segment. We offered help where we could, and it just happened for us!” Lester reminisced.

As the startup ecosystem comes into focus for Malaysia with more funds channeled towards that segment, Lester observed that startups will need technology excellence to support their respective businesses as well as focus on business model development. That is where CloudMile comes in.

This isn’t the only advantage the managed service provider can provide for startups. Lester demonstrated this when he emphasized the importance of people and culture, two ingredients that his organization has in spades, in helping businesses succeed.

Metrics for a managed services provider

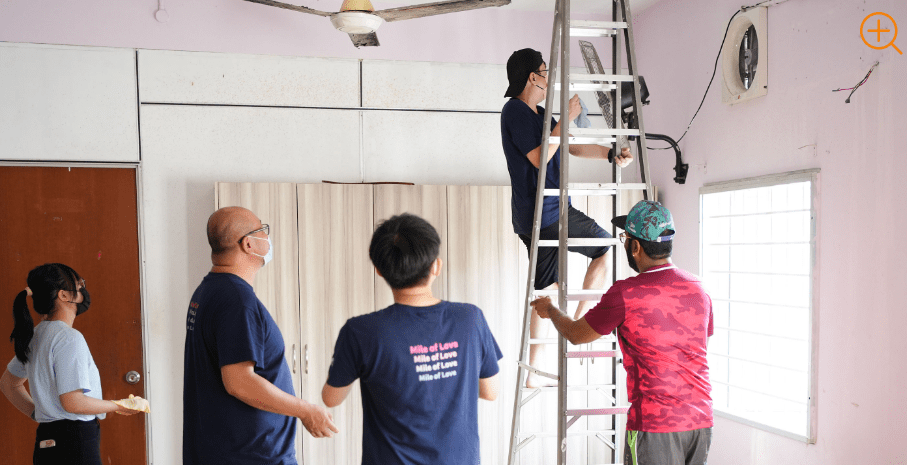

“I want my team to see beyond just money,” Lester said. When asked about how CloudMile enables positive customer experiences, he emphasized a strong culture of employee well-being, and team bonding through shared activities like Friday wind-down sessions at the office, or via CSR initiatives like blood donations and purchasing cookies from charity homes.

The “Mile of Love” events helped the IQ70 Plus non-profit clean the interior facility.

“Employee happiness, morale and wellness, is a very important metric for us. That’s definitely top of my priority list,” Lester said.

Besides that, CSAT, or customer satisfaction scores, matter to CloudMile. “It is definitely very important. Of course we need to ensure that the services and support we provide our clients meet certain expectations and our client’s baseline.”

On that note, he described customers as being their partners. “It’s not just transactional, but a journey that we go on together, and the experience of it is a vital metric for us.”