Digital exchanges have come and gone. Careful execution of elements like governance, compliance, and cybersecurity can ensure its longevity in the market, while convenience, usability, and responsive support to feedback, keeps its customers coming back for more. CXpose.tech discovered this while interviewing Tokenize Xchange’s CEO and founder, Hong Qi Yu.

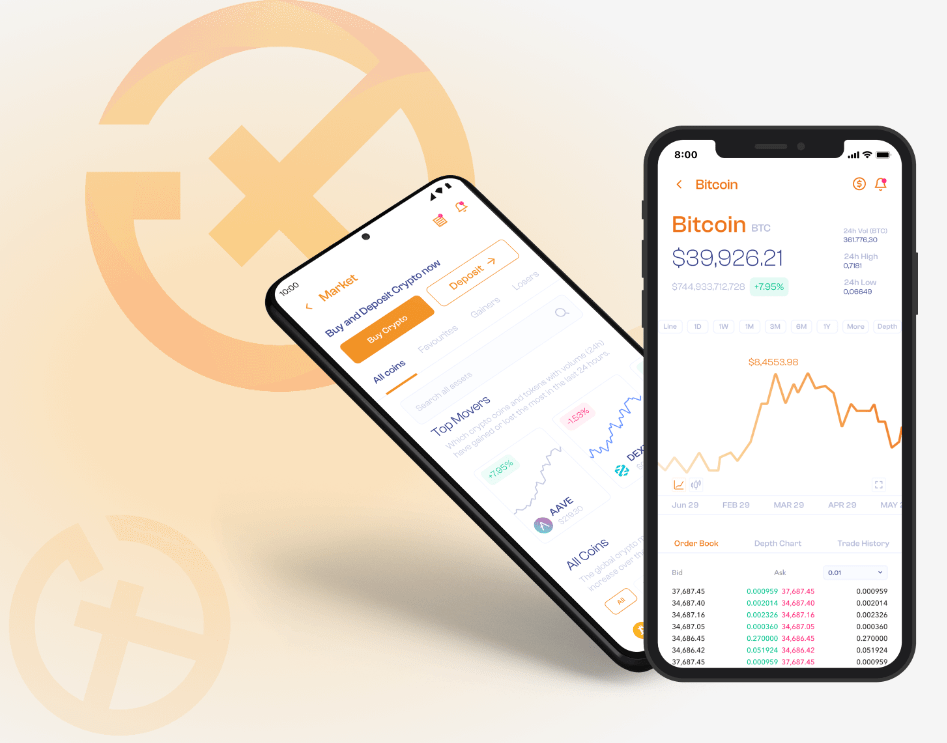

Tokenize Xchange (Tokenize), a leading digital asset exchange headquartered out of Singapore, has an interesting mission to offer secure and intuitive trading experiences for its users.

Founded in 2017 by Hong Qi Yu who is an NTU graduate, Tokenize focuses on innovation, reliability, and customer service when individuals and institutions buy, sell, and trade a wide range of cryptocurrencies on their platform.

Today, Tokenize stands as the second largest digital asset exchange in Malaysia, and one of three operators to receive full approval from regulators in the country. It also operates in Singapore and Vietnam with a view to expand to other Southeast Asian countries in the very near future.

Origins

Hong Qi Yu, Tokenize Xchange

Tokenize Exchange was born out of Qi Yu’s pure need to increase liquidity and access to cryptocurrencies in Singapore.

“Back then, to get access to cryptocurrencies to buy bitcoins was very difficult. I think that was what inspired me to start my own company,” Qi Yu said. “The reason why I could not get bitcoins or ethereum in 2017 was because there were no robust platforms in Singapore. So, interested traders had to resort to platforms that originated in the U.S. or Japan.

“My idea was to create the most robust, simplest, and easiest-to-use exchange that is local, started by Singapore residents and is for Singapore residents. And in this way, bring liquidity to Singapore.”

A booming market

Since that time, the number of digital asset exchanges have risen along with prices of cryptocurrencies like Bitcoin. In 2024 itself, there is a reported surge of interest in cryptos with renewed investor confidence and heightened interest in digital assets.

No doubt, there would be more traders going onto platforms. Digital asset exchanges like Tokenize Xchange need to prepare for this influx of users while at the same time be more appealing to traditional traders, first-time crypto traders, and everybody else in between.

Positive experiences when using the platform would go a long way in being sticky and retaining customer loyalty. But, how to portray cryptocurrencies in a better light so as to allay doubts and fears of potential first-time users, or even users who may have been ‘burnt’ while trading on less reputable platforms?

Qi Yu responded when informed about the enormous complexity of using cryptocurrency platforms, “I have to agree that our industry (have digital exchanges that are) very hard to use. But for us, even though we are a technology company, we are very approachable!”

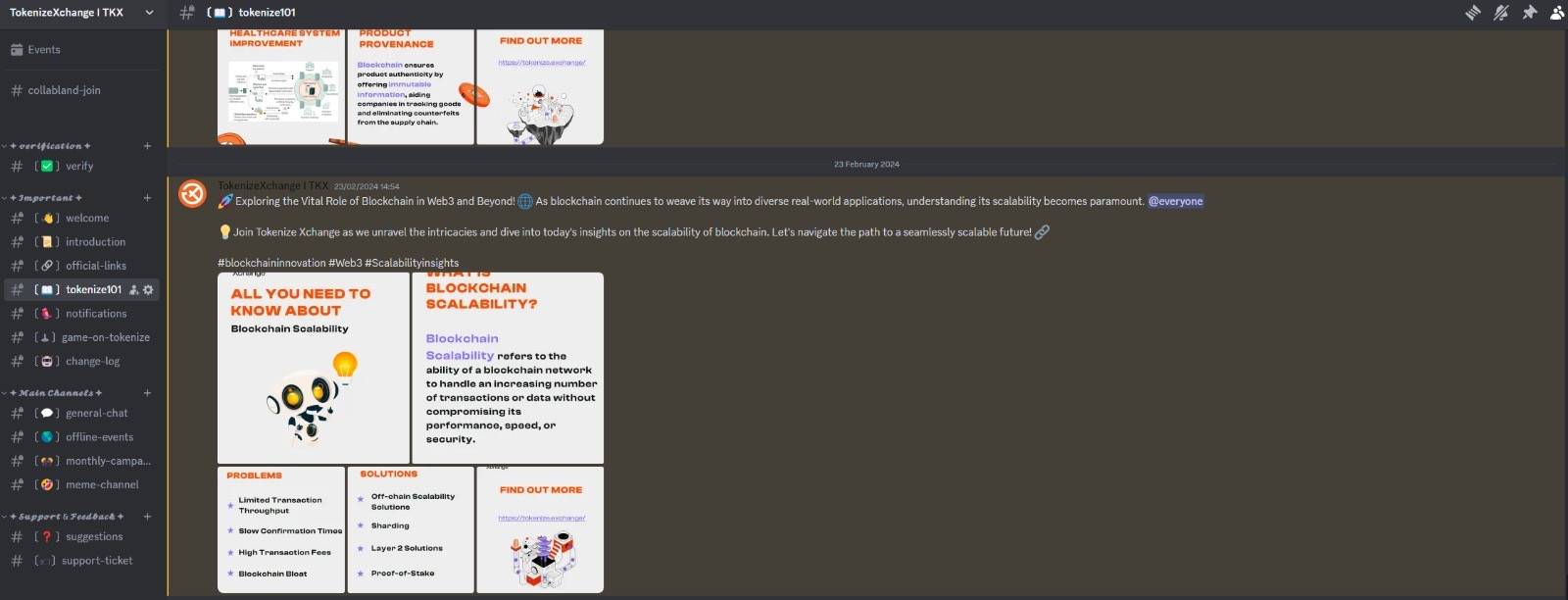

Multiple channels for comprehensive support

The digital exchange has multiple touchpoints for clients to interact with, like Facebook, Telegram, and Discord.

In the live chats, Tokenize’s community of institutional and accredited investors can find real-time assistance to their queries, while novice traders have a wealth of resources like FAQs and tutorials to tap into. Email queries are also guaranteed with responses in 24 hours, which Qi Yu takes pride in.

“I have to agree that our industry (have digital exchanges that are) very hard to use. But for us, even though we are a technology company, we are very approachable!”

Besides these technology-powered channels to engage clients, there is also a layer of human-powered customer success agents that have helped humanize a very technical industry and made it more approachable as Qi Yu said, by driving tasks like onboarding and guiding new traders, as well as answering inquiries and troubleshooting problems encountered on the platform.

Round the clock support, real-time assistance, and a comprehensive FAQ section are offered to resolve issues promptly and increase user satisfaction.

Another contributing factor to Tokenize’s high customer retention rates, is its feedback loop which Qi Yu said it takes very seriously.

The exchange has received a variety of feedback from traders with regards to matters like small interface changes to larger issues like fees. Usable customer feedback is almost always implemented even if it is ultimately costly for Tokenize like trading fees that are lower.

But it is a formula that is working in Tokenize’s favour. Maintaining a continuous feedback loop has helped to ensure an intuitive experience for traders, and integrating user feedback into its continuous improvement process, ensures the platform evolves in alignment with its community’s needs and preferences.

Roadmap

During the interview, Qi Yu had mentioned Tokenize intends to launch its own layer one blockchain by early April. Also known as a main network, this primary blockchain network – where actual transactions occur and native cryptocurrency is used– is meant to be an alternative option for Tokenize traders to use.

The organization also invests heavily in cybersecurity, being certified with the ISO 27001 standard, and engaging external parties to conduct regular penetration tests and vulnerability assessments, or VAPT.

When speaking to Qi Yu about the 19% stake by Malaysian investment bank; Kenanga; he observed that shared KPIs had focused it on governance and compliance within the company which in turn helped it strengthen its financial standing. More recently, a series A fundraising round added US11.5 million dollars to its reserves.

Tokenize plans to remain at the forefront of innovation, focusing on user experiences and market needs. It recognizes the value of artificial intelligence technology as well, but Qi Yu pointed out it is not interested in simply providing AI as a tool for customers. Rather it wants to harness the technology to provide upgraded experiences – for example, what if an AI-driven ‘trader’ could perform tasks like trading for users via the user’s voice commands?

The company is serious about simplifying the use of its platform and empowering its traders. No matter how new or veteran they are, traders should be able to focus on the business of trading with as little learning curve as possible when it comes to navigating the platform.